What the Future of India E2W Market Looks Like (2022-2028)?

A comprehensive overview of the India E2W Market is recently added by UnivDatos Market Insights to its humongous database. The report has been aggregated by collecting informative data from various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the India E2W Market. The report offers a detailed analysis of the latest industry developments and trending factors that are influencing market growth. Furthermore, this statistical market research repository examines and estimates the India E2W Market at the regional levels. The India E2W Market is expected to witness CAGR growth of more than 71% by 2027.

Request Sample Copy of this Report @ https://univdatos.com/get-a-free-sample-form-php/?product_id=13045

Market Overview

Adoption of E2W is expected to be driven by the rising fuel prices, declining battery prices and growth in investments from the local battery manufacturers. Investment in the E2W space witness a decline in FY2021, compared to FY2020, owing to the COVID pandemic, which witnessed delayed investment plans from numerous organizations. Investment in FY 2021 from the E2W OEMs was majorly done for premium HS E2W, accounting for almost 80% of the total investment in the E2W space in India. The FAME-II initiative have brought down the price of E2W closer to the prices of ICE-2 wheelers. Furthermore, adoption of E2W is expected to witness significant disruption post 2023, once the cost of battery decline to US$100/ kWh (INR 7,625.25/kWh).

India E2W Market report is studied thoroughly with several aspects that would help stakeholders in making their decisions more curated.

By Vehicle Type, the market is primarily bifurcated into:

· E-Scooter/Moped

· E-Motorcycle

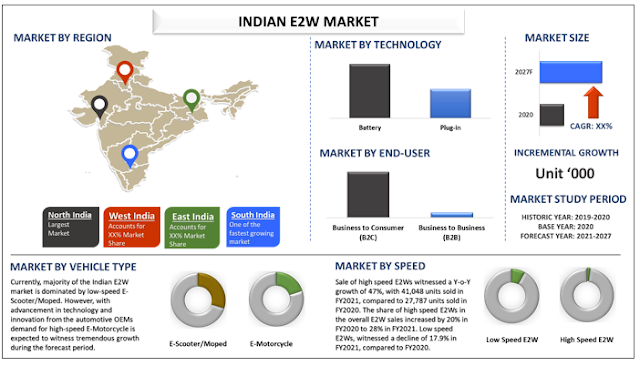

Based on vehicle type, Indian E2W market is dominated by low-speed E-Scooter/Moped. However, with advancement in technology and innovation from the automotive OEMs demand for high-speed E-Motorcycle is expected to witness tremendous growth during the forecast period.

Ask for Price & Discounts @ https://univdatos.com/get-a-free-sample-form-php/?product_id=13045

By Speed, the market is primarily studied into:

· Low Speed E2W

· High Speed E2W

Based on speed, Low Speed E2W in the form of E-Scooter/Moped with speed up to 25 KMPH dominates the market, however, by 2025 demand for High Speed E2W in the form of E-Motorcycle is expected to skyrocket. Sale of high speed E2Ws witnessed a Y-o-Y growth of 47%, with 41,048 units sold in FY2021, compared to 27,787 units sold in FY2020.

By Technology, the market is primarily studied into:

· Battery

· Plug-in

Based on technology, demand for battery E2W is more compared to Plug-in E2W. With falling battery prices, electric bike prices are becoming comparable to their petrol counterparts in terms of operating cost. Battery prices are falling, and it will keep falling before getting stable. For instance: Ola invested INR 2,400-crore in 2020 for setting up its first mega electric scooter factory in Tamil Nadu. Ola claims that it will create an annual capacity of 10 million vehicles.

By End-User, the market is primarily studied into:

· Business to Consumer (B2C)

· Business to Business (B2B)

Based on end-user, Business to Consumer (B2C) segment of the market dominate the market. However, increasing demand of E2W from businesses to shift their fleet to E2Ws to leverage the better economics would help the Business to Business (B2B) segment to witness high growth during the forecast period. In 2018, the hyperlocal segment, where two-wheelers (2W) are the preferred mode of delivery, raised investments of about INR 612 crore.

For more informative information, please visit us @ https://univdatos.com/report/india-e2w-market/

India E2W Market Region Segmentation Includes:

· North India

· East India

· West India

· South India

Based on the estimation, South India is expected to witness high adoption of E2W during the forecast period. Sale of overall E2W has witnessed a strong government push over the last two years to increase EV penetration in India. Apart from the central- and state-level policy measures and increasing consumer awareness, the increasing growth in sales post lockdown were driven mainly due to the rising fuel prices, declining cost of E2W owing to decreasing cost of battery, among others.

The major players targeting the market includes:

· Hero Electric

· Okinawa

· Ather Energy

· Ampere Vehicles

· Revolt

· PureEV

· Ola Electric Mobility

· Kinetic Green

· Evolet

· TVS

Competitive Landscape

The degree of competition among prominent companies has been elaborated by analyzing several leading key players operating in the global context. The specialist team of research analysts sheds light on various traits such as global market competition, market share, most recent industry advancements, innovative product launches, partnerships, mergers, or acquisitions by leading companies in the India E2W Market. The major players have been analyzed using different research methodologies for getting insight views on market competition.

For more informative information, please visit us @ https://univdatos.com/report/india-e2w-market/

Key questions resolved through this analytical market research report include:

· What are the latest trends, new patterns, and advancements in the India E2W Market?

· Which factors are influencing the India E2W Market over the forecast period?

· What are the challenges, threats, and risks in the India E2W Market?

· Which factors are propelling and restraining the India E2W Market?

· What are the demanding regions of the India E2W globally?

· What will be the market size in the upcoming years?

· What are the crucial market acquisition strategies and policies applied by the companies?

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature. Please let us know If you have any custom needs.

Labels: India E2W Market

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home