India Two-Wheeler Market - Industry Size, Share, Growth & Forecast 2027 | UnivDatos

Motorcycle

sales in India skyrocketed over the past few years, making the country the

biggest motorcycle market in the world overtaking China in 2016 and achieving a

record volume of 22.4 million units (including commercial three-wheeler) in

2018. The unavailability of public

transportation and growing per capita income have impacted the market

significantly because as the per capita income increases, two-wheelers become

affordable to people.

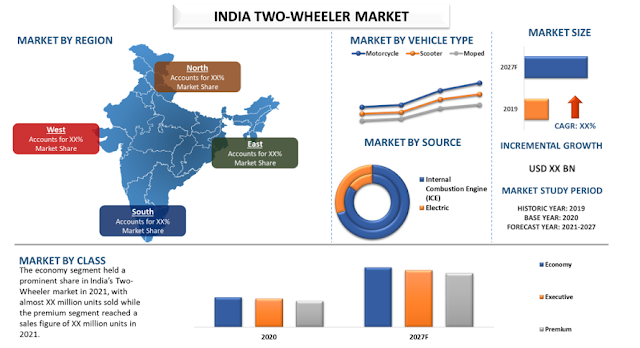

According to UnivDatos Market

Insights (UMI)’ research report “India

Two-Wheeler Market”, the market is expected to witness a CAGR of

around 3% growth during the forecast period (2022-2028). This can be mainly

attributed to the ease for commuters, unavailability of public transportation,

and growing government initiative for the adoption of electric vehicles in

India.

Download Free Sample of this Report - https://univdatos.com/get-a-free-sample-form-php/?product_id=20296

Based on source, India’s

2-wheeler market has been segmented into ICE (Internal Combustion Engine) and

E2W (Electric 2-Wheeler). ICE (Internal Combustion Engine) segment accounts for

the maximum share with nearly XX million ICE 2-wheeler sold in 2021 while only

XX million electric 2-wheeler sold in the same year.

Based on class, India’s 2-wheeler market has been segmented into Economy, Executive, and

Premium. The economy was the largest segment in 2021, with almost XX million

units sold while the premium segment reached a sales figure of XX million units

in 2021.

North India is

expected to witness substantial growth during the forecast period

During

the forecast period, North America is expected to have a higher CAGR due to an

increase in workforce participation and improvement in rural income/disposable

income, which have fueled its demand. India is a massive market for

two-wheelers which accounts for 70% of the 200 million total vehicles running across

the length and breadth of this huge nation. This common man’s commute is also

responsible for over 20% of the total CO2 emissions, and about 30% of the

particulate emissions in urban areas (PM2.5). Since this segment is bound to

grow further, there is an urgent need to switch to a cleaner mode, mainly in

the urban areas, as 7 of the 10 most polluted cities across the world are in

India.

Download Free Sample of this Report - https://univdatos.com/get-a-free-sample-form-php/?product_id=20296

According

to ‘UnivDatos Market Insights (UMI)’, the key

players with a considerable market share operating in India’s Two-Wheeler

Market include Hero MotoCorp Ltd, Bajaj Auto Ltd, TVS

Motor Company, Honda Motorcycle, and Scooter India, Pvt. Ltd, India Yamaha

Motor Pvt. Ltd, Suzuki Motorcycle India, Pvt. Ltd, Mahindra, Royal Enfield

Motors Ltd, Piaggio Vehicles Pvt. Ltd, Triumph Motorcycles (India) Pvt. Ltd,

Hero Electric, Okinawa, Ather Energy, Ampere Vehicles, Revolt, Ola Electric

Mobility. These companies are taking various strategic decisions to increase

their market presence and share.

“India

Two-Wheeler Market” provides comprehensive qualitative and quantitative insights on

the industry potential, key factors impacting sales and purchase decisions,

hotspots, and opportunities available for the market players. Moreover, the

report also encompasses the key strategic imperatives for success for

competitors along with strategic factorial indexing measuring competitors’

capabilities on different parameters. This will help companies in the

formulation of go-to-market strategies and identifying the blue ocean for its

offerings.

For More

Informative Information, Please Visit Us – https://univdatos.com/report/india-two-wheeler-market-2/

Market Segmentation:

1.

By Vehicle Type (Motorcycle,

Scooter, and Moped)

2. By Source (Internal

Combustion Engine (ICE) and Electric)

3. By Class (Economy,

Executive, and Premium)

4. By Region (North

India, East India, West India, and South India)

5. By Company (Hero

MotoCorp Ltd, Bajaj Auto Ltd, TVS Motor Company, Honda Motorcycle, and Scooter

India, Pvt. Ltd, India Yamaha Motor Pvt. Ltd, Suzuki Motorcycle India, Pvt.

Ltd, Mahindra, Royal Enfield Motors Ltd, Piaggio Vehicles Pvt. Ltd, Triumph Motorcycles

(India) Pvt. Ltd, Hero Electric, Okinawa, Ather Energy, Ampere Vehicles,

Revolt, Ola Electric Mobility)

Key questions answered in the study:

1.

What are the current and future trends

of India’s two-wheeler industry?

2.

How the industry has been evolving in

terms of vehicle type, source, and class?

3.

How the competition has been shaping

across the countries followed by their comparative factorial indexing?

4.

What are the key growth drivers and

challenges for India’s two-wheeler industry?

5.

What is the customer orientation,

purchase behavior, and expectations from two-wheeler product suppliers across

various countries?

Table of Content –

1 MARKET INTRODUCTION

2 RESEARCH METHODOLOGY OR ASSUMPTION

3 MARKET SYNOPSIS

4 EXECUTIVE SUMMARY

5 INDIA TWO-WHEELER MARKET COVID-19 IMPACT

6 MARKET INSIGHTS BY VEHICLE TYPE

7 MARKET INSIGHTS BY SOURCE

8 MARKET INSIGHTS BY CLASS

9 MARKET INSIGHTS BY REGION

10 INDIA TWO-WHEELER MARKET DYNAMICS

11 INDIA TWO-WHEELER MARKET OPPORTUNITIES

12 INDIA TWO-WHEELER MARKET TRENDS

13 DEMAND AND SUPPLY SIDE ANALYSIS

14 COMPETITIVE SCENARIO

15 COMPANY PROFILED

16 DISCLAIMER

Browse Other Related Research Reports from UnivDatos

Market Insights

·

Zero

Emission Vehicle Market to Exceed 73.5 Million Sales by 2027 Globally |CAGR:

32.7%

·

Government's

Stringent Regulations to Boost the Market of Radar Based In-Cabin Sensing

Systems

Labels: Two-Wheeler Market

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home