MENA Infrastructure 3D Printing Market Worth US$ 103.7 Million - UnivDatos Industry Analysis- by Size, Share, Growth, Trends, and Forecast 2019-2025

Research report presented by UnivDatos, Emphasis on

Component ((Product (Professional/Industrial Printer, Personal/Desktop 3D

Printers), Material (Polymer, Plastic, Metals and Alloys, Ceramic, Other

Materials), Technology ( Fused Deposition Modelling, Selective Laser Sintering,

Stereolithography, Electron Beam Melting, Laminated object Manufacturing, Other

Technologies), Application (Functional Parts Manufacturing, Fit and Assembly,

Prototype Modelling, Research, Model Casting, Visual Aids, Presentation Modelling,

Other Applications), Construction Method (Extrusion, Powder Bonding), Practice

Area (Construction, Architecture, Others), End-User Sector (Commercial,

Residential, Industrial, Others) and Geographical analysis (key regions

and countries).

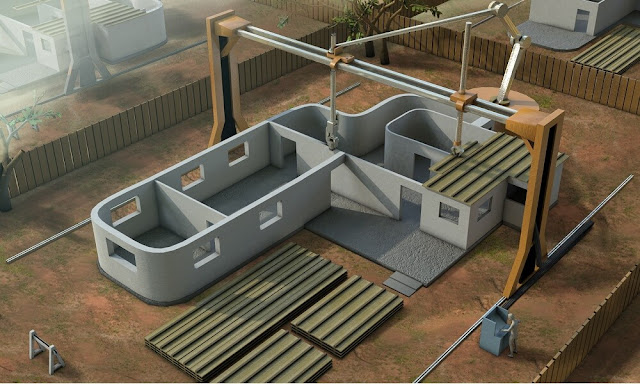

As per the research report, MENA Infrastructure 3D Printing Market was valued

at US$ 37.54 Million in 2018 and is anticipated to reach US$ 103.7 Million by

2025 displaying a reasonable CAGR of 13.5% over the forecast period

(2019-2025). 3D printing, also known as additive manufacturing,

is a collection of methods for creating three-dimensional structures using a

three-dimensional model or other computer data sources. Multiple layers of

various printing materials are shaped under machine control to create a

3-dimensional structure in the case of 3D printing. According to International

Data Corporation (IDC), investment on 3D printing in the Middle East and Africa

(MEA) is expected to rise from US$470 million in 2015 to US$1.3 billion by

2019. 3D printing is increasingly gaining traction in fields involving physical

parts, all the way up to large-scale manufacturing. Concrete, steel, and

ceramics are only a few of the products that new printing methods can

accommodate. Designers need to represent and imagine the object in 3D, so 3D

printing and its use in the construction/infrastructure industry has seen

widespread acceptance. Construction is a promising opportunity for 3D printing

because the majority of the knowledge used to produce an object is generated

during the design process, and the industry is already familiar with

computer-aided manufacturing. Furthermore, the advent of building information

modelling (BIM) will open up a slew of new possibilities for the

construction/infrastructure sector's use of technology. 3D printing technology

is used in the design industry to create construction parts or to print the

whole building frame. The use of 3D printing technology is seen as a potential

response to the global housing crisis.

For complete research, request for

Sample of the report browse through – https://univdatos.com/request_form/form/309

Benefits of 3D Printing in the Construction Sector

·

Labor Efficiency: Based on the statement’s information given by

Winsun, 3D printing can reduce labor and material cost by 90% and 50%

respectively, the opportunity cost savings are projected at £19,000 (US$

24,794.15) labor wise and £7,400 (US$ 9,656.67) material-wise, adding up to a

total of £26,400 (US$ 34,450.81) per unit house

·

Time and Costs Savings: Application of 3D printing is projected to

effectively reduce the overall expenditures of construction projects. Companies

have implemented 3D printing to reduce the material cost by almost half of the

original cost

·

Environmental/ Economic Aspects: Emerging 3D printing firms such as

Winsun and CyBe are developing new innovations to increase the usage of cheaper

and recycled resources, such as mixed clay and fly ash, to create optimized

concrete

·

Design Complexity: Many architectural projects are rejected either

because of excessive cost or design complexity, but with the use of 3D printing

this may not be the case. 3D printing would introduce an array of complex and

haling designs that are only limited by the designer’s imagination and computer

design capabilities. Designs can be easily programmed and achieved by 3D printing

The implementation

of 3D printing technology in the Construction/Infrastructure sector in the MENA

region is being driven by increasing investment on product creation and R&D

operations, rising regulatory funding from national and local government

bodies, and the infrastructure development in the region. Furthermore, with the

establishment of AED 6 million (US$ 1.63 million) Concretive Middle East, a

collaboration between Freyssinet, e-construct, and Draw Link Group, concrete 3D

printing is going to an industrial scale in the UAE.

“Amongst component type, product (Printer) segment dominated the market,

accounting for 36.4% share in 2018”

The report divides

the MENA infrastructure 3D Printing market into product, content, service, and

other segments based on component (software). The product category led the

industry in 2018 and is projected to continue to do so in the forecast period

2019-2025.

“Professional Printers was the most used printer type, followed by

desktop printers”

The industry is

divided into Professional/Industrial Printers and Personal/Desktop 3D Printers

based on the commodity (printer). Professional/Industrial Printers led the MENA

Infrastructure 3D Printing industry and are expected to continue to do so for

the duration of the study. During the forecasted era, the Desktop 3D Printer

market is projected to expand at a CAGR of 15.2 percent.

For a detailed analysis of the applications in the MENA

Infrastructure 3D Printing Market browse through – https://univdatos.com/report/mena-infrastructure-3d-printing-market-current-scenario-and-forecast-2019-2025

“Amongst material type, the concrete segment accounted for 33.7% in 2018

and is projected to dominate the MENA Infrastructure 3D Printing market by

2025.”

The study divides

the MENA Infrastructure 3D Printing industry into concrete, plastic, metal and

alloys, ceramic, and others based on material form. The concrete segment led

the market in 2018, but the ceramic segment is projected to rise at a CAGR of

15.5 percent over the forecasted span. The industry is divided into two types

of services: custom design and manufacturing and after-sales support. In the

MENA Infrastructure 3D Printing industry, Custom Design and Manufacturing

produced revenue of US$ 4.06 million in 2018.

“Fused Deposition Modelling technology dominated the market with a 31.6%

share in 2018”

Fused Deposition

Modelling, selective laser sintering, stereolithography, electron beam melting,

and laminated object production are among the technologies used in the MENA

infrastructure 3D Printing industry. Fused Deposition Modelling technology led

the industry in 2018, but Electron Beam Melting technology is predicted to rise

at the fastest rate of 15.9% over the forecast period.

“Amongst application type, Functional Parts are anticipated to dominate

the MENA Infrastructure 3D Printing market by 2025.”

The industry is

divided into Functional Parts, Fit and Assembly, Prototype Modelling, Training

& Consulting, Metal Casting, Metal Casting, Visual Aids, and Presentation

Modelling, depending on the application category. In the regional 3D printing

industry in 2018, practical parts had the largest share, led by fit and

assembly. However, due to the growing trend, the Oncology application form will

grow during the prediction.

“Amongst construction method type, Extrusion method dominated the market

and is expected to retain dominance throughout the forecast period”

The industry is

split into two categories based on the construction method: extrusion and

powder bonding. In 2018, the extrusion type had the highest share of 72.1

percent. During the forecasted duration of 2019-2025, the segment is projected

to rise at the fastest CAGR. The MENA Infrastructure 3D Printing industry

is divided into design, architecture, and other practise areas. The

construction industry led the market in 2018, bringing in US$ 28.89 million in

sales. The MENA Infrastructure 3D Printing industry is further divided into

consumer, residential, manufacturing, and other end-users. In 2018, the

commercial segment dominated the market; however, during the analysed

timeframe, the residential sector is projected to see the highest adoption of

3D printing in the MENA region.

“UAE represents one of the largest markets of MENA Infrastructure 3D

Printing industry”

The MENA

Infrastructure 3D Printing industry is examined in terms of its reach in

countries such as the United Arab Emirates, Qatar, Saudi Arabia, Kuwait, Egypt,

Algeria, and the rest of the Middle East and North Africa. In the MENA field,

the UAE is the most advanced user of 3D printing technology. In 2018, the UAE

had an 18.4 percent share of the MENA Infrastructure 3D Printing market. Saudi

Arabia, Qatar, and Egypt, among others, are important markets in the field,

with many research and development programmes aimed at revolutionising advanced

technology applications in the construction industry. The first 3D printing

office was installed in Dubai in 2016. (UAE).

Customization Options:

UMI understands

that you may have your own business need, hence we also provide fully

customized solutions to clients. The MENA Infrastructure 3D Printing Market can be customized to an additional country level

or any other market segment.

Table of Contents

Chapter 1

Market Introduction

Chapter 2

Research Methodology or Assumption

Chapter 3

Industry Performance

Chapter 4 Executive

Summary

Chapter 5

Market Overview

Chapter 6

Demand and Supply Side Analysis

Chapter 7 Top

News Related To 3d Printing in Middle East And North Africa Region

Chapter 8 Mena

Infrastructure 3d Printing Value Chain

Chapter 9

Market Insights, By Component (Us$)

Chapter 10 Market

Insights, By Technology Type (Us$)

Chapter 11 Market

Insights, By Application Type (Us$)

Chapter 12 Market

Insights, By Construction Method (Us$)

Chapter 13 Market

Insights, By Practice Area (Us$)

Chapter 14 Market

Insights, By End User Sector (Us$)

Chapter 15 Market

Insights, By Country

Chapter 16 Competitive Scenario

Chapter 17 Top

Company Profiles - 3D Systems Corporation, 3D Vinci Creation, BESIX Group, COBOD

International, CyBe Construction, Generation 3D, Massivit 3D Printing

Technologies Ltd

Labels: Infrastructure 3D Printing Market, Infrastructure 3D Printing Market growth, Infrastructure 3D Printing Market share, Infrastructure 3D Printing Market size

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home